The IRS has released (Announcement 2022-13) revisions to the 2022 standard mileage rates. The rates are used to determine the deductible costs of using a vehicle for business, charitable, medical, or moving purposes. The new rates are effective July 1, 2022. The increased rates are a revision to Notice 2022-03, which is still effective for travel from January 1st through June 30th. The mid-year special adjustment is in recognition of gasoline price increases.

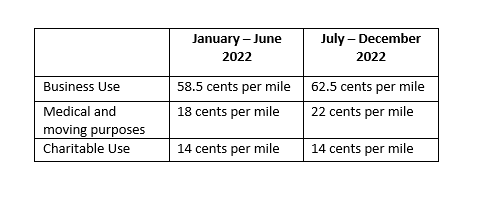

The new rates are as follows, compared to the original 2022 rates:

This means taxpayers will need to provide their mileage separately for the two halves of the year when they organize their 2022 tax information.

We're Here to Help

From business growth to compliance and digital optimization, Eide Bailly is here to help you thrive and embrace opportunity.

Speak to our specialists