Get out and vote today! (The tax agenda will likely be shaped by it.)

Almost time for some policymaking — maybe – Bernie Becker, Politico:

As plenty of observers have noted, the midterm results likely will influence how ambitious the two parties are in the upcoming lame-duck session.

That will in turn help decide both whether Congress passes yet another year-end tax bill, and how sweeping it might be. (For whatever it’s worth, the expectation — or at least fervent hope — for many tax people is that some tax-related measures will pass before 2023.)

But there are also longer-term questions to consider, too — like how tax policy might look in the next Congress...

The possibilities are absolutely endless on what tax provisions Congress might pass in the lame duck session - tax increases included in the House-passed Build Back Better bill, allowing R&D costs to be expensed, broadening the interest deduction, extending recently expired tax breaks, ESOP provisions, retirement tax measures - OR they could do nothing at all.

Direction of Key Tax Measures on Ballot as Election Day Arrives – Alexander Rifaat, Tax Notes ($):

Taxes may not be top of mind for voters as they head to the polls today, but the results of the midterm elections will have major implications on the trajectory of tax provisions.

Further down the article:

Republicans, who are projected to take control of the House and possibly the Senate, have made repealing the IRS’s nearly $80 billion in additional funding and making some provisions in the Tax Cuts and Jobs Act permanent part of their campaign pitch to voters.

Meanwhile, President Biden and Democrats have sought to promote tax measures in the recently enacted CHIPS and Science Act of 2022 (P.L. 117-167) and Inflation Reduction Act (P.L. 117-169) — which, in addition to extra funds for the IRS, includes a 15 percent corporate minimum tax rate and climate-related energy tax credits — and have warned that Republican tax proposals would add $3 trillion to the federal deficit and mostly benefit wealthy Americans.

Republican takeover of U.S. Congress would mean tax fights are back – David Lawder, Reuters:

Republicans aiming to win control of Congress on Tuesday say they plan to force President Joe Biden into a difficult choice on taxes: sign Republican legislation to make their 2017 tax cuts permanent or veto it and be branded as the president who put tax hikes on middle class Americans.

Congressional Republicans' tax strategies and a Democratic White House could ultimately mean a status quo on rates, deductions and credits for the next two years, tax professionals and analysts say.

But expect the political heat they generate to last until the 2024 presidential election.

Ask any pundit and they will tell you that President Biden will not sign into law a bill that extends the provisions in the 2017 tax reform bill. Some of them might even laugh at the suggestion that a Democratic President would extend tax provisions championed by Republicans. However, in 2010, that is exactly what happened. And the economic and political circumstances that existed in 2010 could soon present themselves again - making the idea of a Democratic President extending tax provisions championed by Republicans not so outlandish. More on this here.

Ford, Dell, Netflix CFOs Call on Congress for R&D Break - Chris Cioffi, Bloomberg ($). “The chief financial officers of 178 companies called on Congress to restore a tax break on research and development expense amortization, warning that failing to do so could lead to job losses and hurt competitiveness.”

‘With wages and salaries accounting for 70% of R&D spending, the amortization requirement is expected to result in a loss of over 23,400 direct R&D jobs each year for the next five years, according to an analysis by EY,’ according to the letter, which was signed by the CFOs of companies such as Intel, 3M, Kimberly-Clark and T-Mobile.

Congress is getting a lot of pressure from organizations and business about R&D expensing. Currently, the provision is attached to expanding the Child Tax Credit, i.e., don’t enact one without the other. This coupling might disappear after the election, which would allow R&D expensing to pass. But nothing is certain at this point.

Republicans Demand Update on IRS Backlog, Customer Service Plans - Samantha Handler, Bloomberg ($):

Top Republicans on the Ways and Means Committee want an update from the Internal Revenue Service on its handling of 7.9 million unprocessed tax returns and how the agency will manage future backlogs, according to a letter sent Thursday.

Reps. Kevin Brady (R-Texas), the committee’s ranking member, and Darin LaHood (R-Ill.) are demanding a status update on the backlog by the end of the year, saying 17.2 million tax returns still are pending on top of the unprocessed returns. The Treasury Department Inspector General for Tax Administration found in a September report that the IRS still had ‘significant inventory backlogs.’

Two things are certain if Republican win the House majority: 1. There will be an oversight hearing(s) on the $80 billion IRS funding and if it’s improving things. 2. There will be oversight hearing(s) on how ProPublica got its hands on confidential tax information that it reported in articles.

Small Businesses Turn to Zelle for a Loophole in the New Tax Law - Arianne Cohen, Bloomberg ($):

Early this year, Benson Gitau, owner of Houston appliance reseller Vendapp, noticed that his suppliers were no longer accepting payments through Venmo, PayPal or Cash App. “They’d just say, ‘I prefer Zelle,’” he says. The share of his suppliers using Zelle jumped to 60% from 15% in a few weeks. “A couple of them talked about why. It’s because, at the end of the day, with Zelle or cash, they decide what to show to the IRS.”

He’s referring to an IRS rule change that came into effect on Jan. 1, 2022, requiring third-party payment processors such as Venmo and PayPal to issue 1099-K forms to any users who receive more than $600 in payments via their apps and also file them directly with the IRS. Previously, Venmo and other apps issued 1099-Ks only for customers with gross payments exceeding $20,000 who’d made more than 200 such transactions. But small businesses nationwide have found a loophole: Zelle. Zelle says the new rule doesn’t apply to it, a bank-to-bank payment service, because it’s a network that doesn’t hold funds.

Grantor Trust Guidance Has Only One Likely Outcome, Observers Say – Jonathan Curry, Tax Notes ($). “Pending guidance from the IRS and Treasury on grantor trusts and the tax-free step-up in basis isn’t going to have a taxpayer-friendly ending.”

Further down the article:

‘They’re going to say you can’t do it, that you don’t get a step-up in basis,’ Jonathan Blattmachr of Pioneer Wealth Partners, one of the small cadre of estate planners who holds otherwise, told Tax Notes. ‘I would practically stake my cat’s life on it. And I like my cat.’

Pascrell Welcomes IRS Estate Tax Item In Guidance Plan – Naomi Jagoda, Bloomberg ($):

Practitioners and a key lawmaker welcomed the addition of a new estate-tax item on the 2022-2023 IRS priority guidance plan released Friday that will address whether certain trust assets are eligible for stepped-up basis.

The plan includes a guidance project on the availability of stepped-up basis for grantor trusts when the assets in the trust are excluded from the owner’s estate for estate-tax purposes. Stepped-up basis means that when an heir sells an inherited asset, the heir only has to pay capital-gains taxes on the increase in value that occurred after the decedent’s death.

Further down the article:

Estate-tax lawyers said they expect the guidance to provide that the trust assets aren’t eligible for stepped-up basis.

Treasury and IRS expand program for approving certain retirement plans – IRS:

The Treasury Department and Internal Revenue Service today announced the expansion of one of their programs for approving retirement plans. The IRS will now allow 403(b) retirement plans, which are used by certain public schools, churches and charities, to use the same individually designed retirement plan determination letter program currently used by qualified retirement plans.

The document is here.

Supreme Court Skips Minnesota Self-Storage Property Tax Dispute - Perry Cooper, Bloomberg ($):

The US Supreme Court declined to consider whether a Minnesota self-storage business was given a fair chance to challenge the county’s tax assessment of its property.

The Minnesota Supreme Court upheld Washington County’s assessment of Chambers Self-Storage Oakdale LLC property at $2.74 million for 2016 and $2.81 million for 2017, finding the company failed to present data on the actual market value and assessed value of its property compared with similar properties in the county.

Court Denies IRS Instructions Request in Crypto Records Grab - Aysha Bagchi, Bloomberg ($). “An appeals court judicial panel has declined to provide broader instructions to a trial court on what to consider in a lawsuit challenging the constitutionality of an IRS seizure of cryptocurrency records.”

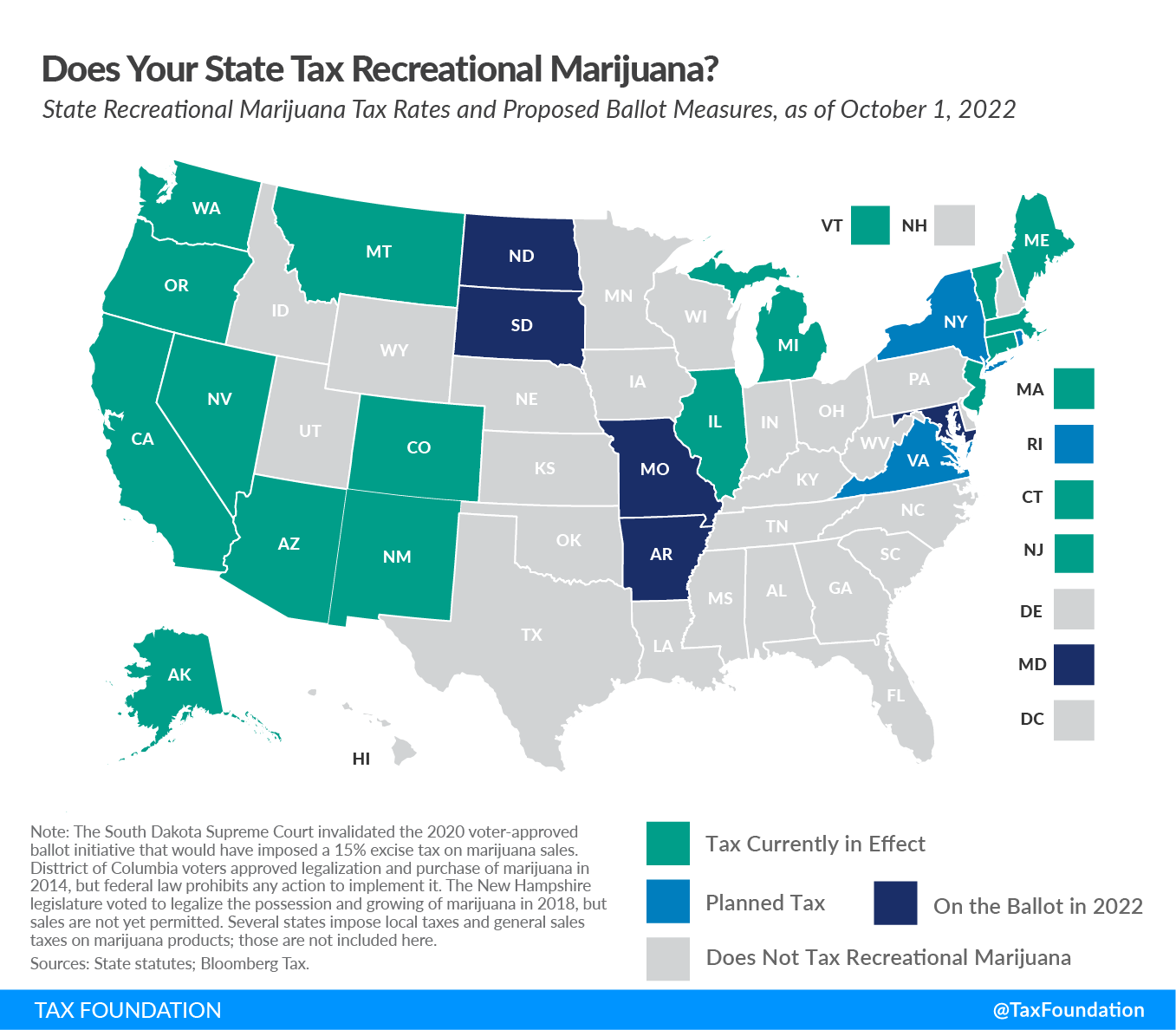

How High Are Taxes on Recreational Marijuana in Your State? – Tax Foundation:

State recreational marijuana taxes are one of the hottest policy issues in the U.S. Currently, 19 states (Alaska, Arizona, California, Colorado, Connecticut, Illinois, Maine, Massachusetts, Michigan, Montana, Nevada, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont, Virginia, and Washington) have implemented legislation to legalize and tax recreational marijuana sales.

Millionaire Tax Bite Threatened to Grow After Voters Have a Say - Laura Mahoney, Bloomberg ($):

Extra taxes on the wealthy are on the ballot in California and Massachusetts, with voters deciding whether they want to ding their richest neighbors to pay for electric vehicle infrastructure, education, and transportation projects.

Voters in Colorado will decide whether to creatively get more from the wealthy by limiting their deductions while ever so slightly cutting the state income tax rate.

Those ballot questions are part of a mixed bag of revenue-raising proposals across the country.

Texas Governor’s “Taxpayer Bill of Rights” Plan Targets the Muni Bond Market - Joe Mysak, Bloomberg ($):

It will become just a little bit harder for Texas municipalities to get approval for their borrowing plans if Governor Greg Abbott of Texas gets his way.

The governor is running for a third term on Tuesday, and wants to require, among other things, that local debt be passed by a supermajority of the local government authorizing it. He put the local government debt proposal in a ‘Taxpayer Bill of Rights’ he unveiled earlier this year, which as far as I can tell has been little noticed.

FTC Proposed Regs Are Days Away, IRS Official Says – Amanda Athanasiou, Tax Notes ($). “Proposed foreign tax credit regulations may be less than two weeks away, an IRS official said, adding that several issues that have attracted comments will be addressed, but not always in the way commenters hope.”

‘Though the notice of proposed rulemaking hasn’t been released yet, it was largely done quite a long time ago,’ Peter Blessing, IRS associate chief counsel (international), said November 7 at the 38th annual Tax Executives Institute-San José State University High Tech Tax Institute in Palo Alto, California. ‘Certain aspects and certain parts of the process have kept it from being released, but I do expect it . . . in the next 10 days.’

EU, US must address concerns over U.S. inflation act - German fin min - Rachel More, Reuters:

Germany wants dialogue with Washington rather than tit-for-tat measures to ease trade tensions triggered by the U.S Inflation Reduction Act, which could harm European businesses and industry, Germany's finance minister said on Monday.

Christian Lindner said a task force set up between the United States and the European Union should address the issue urgently.

'The correct path now is to seek dialogue with the U.S. administration in order to exchange concerns and find common ways in which our economic interests can be combined,' Lindner said ahead of talks with his Eurogroup counterparts in Brussels.

EU says it has serious concerns about Biden’s Inflation Reduction Act – Silvia Amaro, CNBC:

European officials have acknowledged the green ambitions associated with the package, but they are worried about 'the way that the financial incentives under the Act are designed,' the document, which will be presented to U.S. officials, says. The EU listed nine of the tax credit provisions that it has an issue with.

Speaking in Brussels, the EU’s trade chief said, ‘We have established a taskforce to deal with these issues ... we are currently concentrating on finding a negotiated solution.’

‘Hopefully, there is willingness from the U.S. to address the concerns which we are having in the EU side,’ Valdis Dombrovskis told CNBC.

Democrats Supercharged EV Investment While They Had the Chance – Craig Trudell and Gabrielle Coppola, Bloomberg ($). “Much of the focus on the Inflation Reduction Act (IRA) that Biden signed into law in mid-August has been on how it adjusts tax credits for electric-vehicle purchases, whether these new provisions are too stringent for manufacturers to meet, and if they unfairly discriminate against manufacturers based in ally countries including South Korea and Japan.”

Further down the article:

The tax credit consists of $35 per kilowatt hour for battery cell assembly, and another $10 per kWh for battery packs. In a report authored by 21 analysts last month, UBS estimated that battery cell prices were hovering around $140 per kWH, meaning the tax credit will cover 25% to 30% of total cell manufacturing costs.

Today is Election Day! For those who voted early, it’s also National Cappuccino Day – which can help keep you alert to monitor late-night election results - and National Harvey Wallbanger Day – in case you don’t like those results!

We're Here to Help