White House official: Biden’s capital gains tax increase would only hit a small slice of taxpayers - Jay Heflin, Eide Bailly. "President Joe Biden in his upcoming speech to a joint session of Congress on April 28, 2021, is expected to lay out a plan that will raise the capital gains tax to 43.4% for individuals earning more than $1 million a year. This number includes the 3.8% Net Investment Income Tax (NIIT)."

Capital gains nonsense - Scott Sumner, Econlog. "You also see the media discuss the 'principle' that capital gains should be taxed the same as wage income. That’s about as sensible as saying that 'in principle', a gallon of gasoline should pay the same tax as a gallon of Scotch whiskey."

California Donor Law Invalid In All Cases, Justices Told - Daniel Tay, Law360 Tax Authority ($). "The justices also probed all parties about the significance of California's past lapses in safeguarding confidential information. California has failed to properly protect donor information — in particular, in cases when Schedule B forms were uploaded to a public-facing website."

SALT Workarounds Spread to More States as Democrats Seek Repeal - Sam McQuillan, Bloomberg Tax ($). "New York and Idaho both recently passed legislation to work around the controversial 2017 tax law feature known as the SALT cap. Their states created an optional tax, letting owners of passthrough entities—where income flows through and is taxed on the ownership level—circumvent the $10,000 limit on deductions."

Be careful: the additional deduction might be come at the cost of a credit for taxes paid in other states on your state tax return.

Eleventh Circuit Joins the Consensus that Reckless Conduct Is Subject to the FBAR Civil Willful Penalty - Jack Townsend, Federal Tax Crimes. "The importance of the holding is that it adds to a number of similar holdings, so that it seems that there is no real counterweight to the holding. It states the consensus."

Related: Offshore Voluntary Disclosure

Reliance and Omitted Income: Taxpayer Cannot Avoid Penalties Even When Using Longtime Preparer - Leslie Book, Procedurally Taxing. "Unfortunately for Walton, she testified that she did not review the return before the preparer e-filed it as she trusted his expertise. That admission was fatal to the defense—even though there was some uncertainty as to whether she gave all 1099 MISC’s to her preparer, the failure on Walton’s part to review the return led to a finding that she failed to act with the prudence and diligence necessary to avoid the penalty."

29 million tax returns awaiting manual IRS processing - Kay Bell, Don't Mess With Taxes. "'As one would expect, IRS employees are stretched thin working through the manual processing of these returns, so if a taxpayer’s return is pulled for manual processing, there will be delays,' notes a post last week on the NTA Blog."

Mont. House OKs Cutting Income Tax, Slashing Brackets - Paul Williams, Law360 Tax Authority ($):

The bills, S.B. 159 and S.B. 399, would work in tandem to cut Montana's top income tax rate to 6.75% from 6.9% next year, then to 6.5% in 2024, when the state's income tax brackets would be reduced from seven to two. The Republican-heavy chamber approved the bills without debate, passing S.B. 159 on a 65-32 vote and S.B. 399 on a 67-31 vote. The measures will return to the Republican-controlled Senate for concurrence with prior amendments the House added to the measures.

Under S.B. 159, the drop in the top tax rate would be paused or repealed if the state's budget director determines that the tax cut would trigger the clawback provision of the federal American Rescue Plan Act .

Republicans’ tax policy debates among unresolved legislative issues - Erin Murphy, The Daily Nonpareil. "Tax policy, in particular, seems to be blocking the exits out of the Iowa Capitol. Myriad proposals are being considered, and Republican majorities in the Senate and House have not yet been able to agree on which to approve and send to the desk of Republican Gov. Kim Reynolds."

Field of Dreams proposal's bid for state tax help falls short - Elizabeth Kelsey, Telegraph Herald. "The rejection has a slightly bitter sting because the Field of Dreams helped spur the creation of that tax incentive program."

Lesson From The Tax Court: Abatement Of Assessment Brings No Relief From Liability - Bryan Camp, TaxProf Blog:

Letters from the IRS are often confusing, both to clients and to practitioners. So when the taxpayers in Robert Craig Colton and Alina Mazwin v Commissioner, T.C. Memo. 2021-44 (Apr. 21, 2021) (Judge Lauber) received a letter from the IRS saying “you do not owe us any money” for the very year they were disputing in Tax Court, you would not blame them for thinking that the IRS had conceded the case. It hadn't. The letter was only telling them that a premature assessment of the deficiency had been abated, not that the IRS's judgment about the underlying liability had changed.

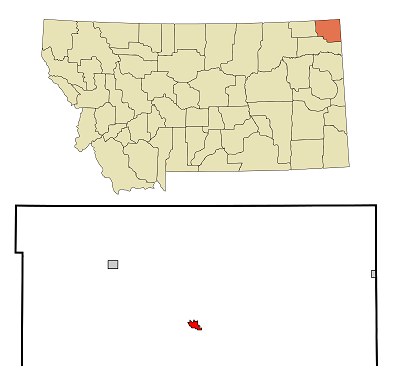

Hollywood? How about Plentywood! A small Northeast Montana town achieved a measure of fame yesterday in Tax Court. We'll let Judge Mark Holmes set the scene:

Plentywood is a town of 1,700 people in northeast Montana. Local legend has it that the nearby Plentywood Creek and the town of Plentywood get their name from a search for firewood. Dutch Henry who, though notorious in Montana history as a skilled horse thief, was reportedly an otherwise pleasant man and a talented cowboy, amused himself one day by watching a chuckwagon cook struggle to start a fire with damp buffalo chips. He finally took pity on the man and told him to hike two miles up the creek where he could find “plenty wood.”

Image via Wikipedia by By Arkyan, CC BY-SA 3.0, via Wikimedia Commons

A small town, but big enough for a pharmacy, and for some tax planning. The drugstore is in a corporation, Plentywood Drug, Inc. The drugstore building is owned personally by the corporation's owners.

The IRS found its way to Plentywood and decided that the rent paid was excessive, and therefore a disguised dividend to the owners to the extent of the excess. This would cost the corporation a deduction. Plentywood Drug paid $192,000 in rent in 2013. The IRS said fair rent was only $58,500 for 2011 and $59,319 for 2012.

But what is the fair rent of a building in a small town in Northeast Montana? There aren't many towns nearby. The IRS appraiser used Williston, North Dakota, as a benchmark, but Judge Holmes disagreed:

Although the properties McIvor [the IRS appraiser] found are very similar to Plentywood Drug's retail space, we also find that the difference in market areas is very great. Williston has a larger population than Plentywood and rents there have been much affected by the oil boom. It's possible that the boom also affected Plentywood, but neither party put in any solid proof of that — for example, evidence of a surge in population or business formation — into the record of these cases. We therefore do not accept the Williston properties as being reasonable comparables.

Ultimately, Judge Holmes settled on annual rent of $171,187.50 - not a complete taxpayer victory, but much nearer the taxpayer's numbers than the IRS numbers. The taxpayers also avoided penalties.

The Moral? The IRS can tax you no matter how far you are from the big city, but even a small town drugstore can go toe-to-toe with the IRS armed with a good appraisal.

Cite: T.C. Memo. 2021-45

Related: The Importance of Business Valuation

Hungry? Today is both National Prime Rib Day and National Babe Ruth Day. Yesterday, Shohei Ohtani became the first pitcher since The Babe to start a big-league game while leading the league in home runs - a feat Babe last accomplished on June 13, 1921. That's worth a nice prime rib dinner.

We're Here to Help