Alabama Governor Signs Business Tax Breaks, COVID-19 Relief - Lauren Loricchio, Tax Notes:

The bill will shift Alabama from three-factor apportionment with a double-weighted sales factor to single-sales-factor apportionment and will repeal the state’s throwback rule.

The measure will retroactively decouple the state from the GILTI provision of the federal Tax Cuts and Jobs Act and limit the application of the business interest expense limitation in IRC section 163(j).

It will also create an elective workaround to the TCJA's $10,000 cap on the state and local tax deduction for passthrough entities. The workaround will allow passthroughs to be taxed at the entity level at the highest marginal individual income tax rate.

Where is My “Tax Home” or Residency in a Post-COVID World? - Cory Stigile, Taxlitigator.com. "States are already fighting over how they may tax workers within and without their states during COVID. For instance, New Hampshire recently filed a Petition to the Supreme Court for leave to file an action challenging Massachusetts’s taxation of New Hampshire residents who work remotely from their homes for Massachusetts businesses."

More Trouble with Notices and More Discussion of Offsets - Keith Fogg, Procedurally Taxing. "The latest correspondence problem does not implicate statutory time frames the way the earlier misdated notices did. Instead, this problem simply involves the IRS sending 109,000 taxpayers a notice with wrong information. The notice not only wrongly tells the taxpayer of action the IRS did not take but contains a typographical error that will compound confusion."

Willful Failure to File FBAR Penalties Were Not Excessive - Ed Zollars, Current Federal Tax Developments. "The IRS was proposing civil penalties of $154,032 for 2007 and the same amount for 2008 for willful failure to report these accounts on the FBAR filings for the years in question."

Related: International Voluntary Disclosure Programs.

Lesson From The Tax Court: The §104(a)(2) Causality Rule - Bryan Camp, TaxProf Blog:

In one respect §104(a)(2) is very broad. It permits taxpayers to exclude from gross income “the amount of any damages (other than punitive damages) received (whether by suit or agreement and whether as lump sums or as periodic payments) on account of personal physical injuries or physical sickness.” I want to emphasize the word “any” in the context of the fully quoted provision. Both are important for today’s lesson.

In another respect, however, §104(a)(2) is narrow. The statute distinguishes between something called “personal physical injuries or physical sickness” and something called “emotional distress.”

If you get a settlement and you want it excluded from income, you need to draft the settlement carefully.

So You Made Money on GameStop, Now What? A Primer on Capital Gains - Ryan Dean Freeman Law. "It is clear that these new investors are here to stay, but one question often remains unanswered for new investors, do I owe tax on all of this? The short answer is yes, but the answer can be quite more nuanced."

Electric Vehicle Tax Credit Explained, Tesla No Longer Eligible - Sam Battista, Tax Warrior Chronicle. "This federal tax credit ranges from $2,500 to $7,500 for qualified electric vehicles that draw energy from a battery. The credit is non-refundable, so to enjoy its benefits, you must have a federal tax liability in the year of purchase and file Form 8936 to claim the credit."

When Can an Employer Provide Nontaxable Local Lodging? - Thomsen Reuters Tax & Accounting. "Whether your local employees will be able to exclude the value of their lodging will depend on whether the lodging qualifies as a working condition fringe benefit."

What COVID-19 expenses can teachers deduct on 2020 returns? - National Association of Tax Professionals. K-12 only.

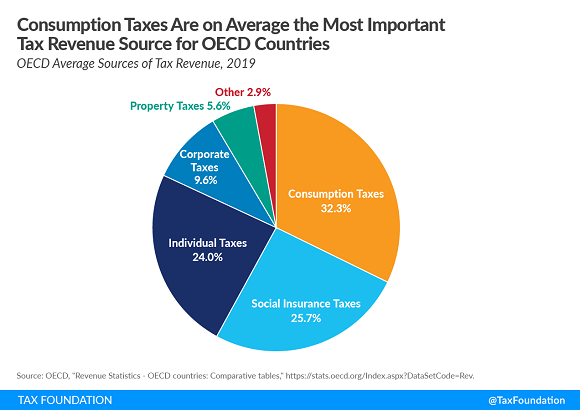

Sources of Government Revenue in the OECD - Cristina Enache, Tax Policy Blog. "In 2019, OECD countries raised on average one-third of their tax revenue through consumption taxes such as the Value-added Tax (VAT), making consumption taxes the most important revenue source."

In the U.S., only 18% of the tax burden is raised via consumption taxes.

Which cities and states have the highest sales tax rates? - Sarah Craig, TaxJar. Gould, Arkansas?

Increasing the Childless EITC Is A Good Start; It Should Include Students Too - Elaine Maag, TaxVox. "In a recent analysis, my colleagues and I found that extending EITC benefits to low-income, independent students would be one way to shore up their finances and help them stay in school."

The Lion, the Polygamist, and the Biofuel Scam - Vince Beiser, Wired. "'It was tax fraud on an almost unimaginable scale,' says Jacob’s own lawyer, Marc Agnifilo. “It’s really a simple fraud. The government is writing these million-dollar checks, $5 million checks, $20 million checks, just because you gave them some paperwork that shows that maybe you made biodiesel.'"

Reviewing key tax changes, and the presidents that championed them, on Presidents Day 2021 - Kay Bell, Don't Mess With Taxes:

1862: Abraham Lincoln signed the into law the first income tax as a way to help pay for Civil War expenses. It levied a 3 percent tax on incomes between $600 and $10,000 and a 5 percent tax on incomes of more than $10,000. The measure also created a Commissioner of Internal Revenue.

Mardi Gras celebrations in New Orleans are cancelled due to Covid. All is not lost, though - today is National Almond Day!

Make a habit of sustained success.