GOP Focuses on School Choice Credits in New ‘Skinny’ Bill - Jad Chamseddine, Tax Notes ($):

A new slimmed-down COVID-19 relief package would temporarily reimburse parents for state-based scholarship funds, increase the deduction for charitable contributions, and continue the small business loan program...

The bill is not expected to pass since it will need at least 60 votes in the Senate, with Democrats accusing McConnell of trying to help vulnerable Republicans with a “check the box” bill.

California Expands Exemptions From Worker Classification Law - Paul Jones, Tax Analysts ($). "A.B. 2257, which takes effect immediately, broadens exemptions for various business contracting arrangements and adds specific exemptions for a range of work types if they meet specific criteria. The work types include freelance graphic and web designers, home inspectors, some insurance industry workers, performance artists, some music industry workers, youth sports coaches, caddies, wedding planners, interpreters, and translators."

Link to bill: Assembly Bill No. 2257

Other coverage:

California Enacts AB 2257, Providing Much-Needed Clarification and Adding Exemptions to AB 5 - Seyfarth Shaw LLP.

California Gov. Gavin Newsom Signs Bill Helping Musicians, Writers And Other Independent Contractors Avoid Job-Killing Rules - Bruce Haring, Deadline.com.

Governor Signs Law Exempting More Occupations from Controversial Assembly Bill 5 - Chris Jennewein, Times of San Diego.

Faulty IRS Systems Blamed for Missing Billions in Bank Reporting - William Hoffman, Tax Notes ($). "Thousands of individuals who deposited cash totaling more than $1.9 billion to financial institutions subject to Bank Secrecy Act reporting didn’t file tax returns in 2017, according to an inspector general’s audit."

Link to TIGTA report: The Accuracy of Currency Transaction Report Data in IRS Systems Should Be Improved to Enhance Its Usefulness for Compliance Purposes

IRS special letter going to non-filers with info on how to get COVID tax relief payments by year's end - Kay Bell, Don't Mess With Taxes. "In fact, the tax agency says around nine million Americans still are due the stimulus."

No Stimulus Check? IRS Tells Non-Filers To Check The Mail To Find Out How To Claim One - Kelly Phillips Erb, Forbes.

Income Earned While Working in Afghanistan Is Not Excludable - Tax Analysts ($). "The Eleventh Circuit, affirming a Tax Court decision, held that a couple couldn’t claim the foreign earned income exclusion under section 911 for income the wife earned while working in Afghanistan because her abode was in the United States."

Free link to opinion: No. 20-10692

Related: Considering Foreign Operations? You Need a Global Mobility Program 2018/1

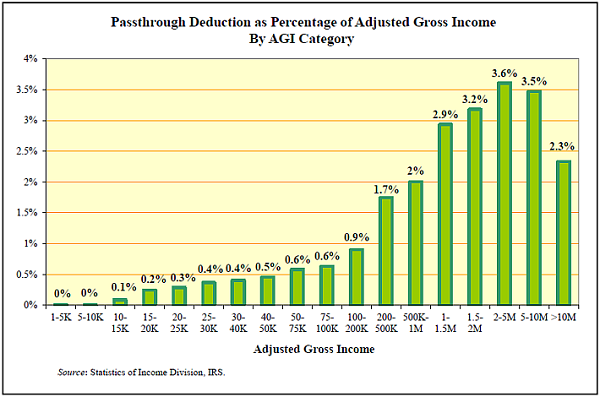

Economic Analysis: 19 Million Taxpayers Take the Passthrough Deduction - Martin Sullivan, Tax Notes ($). "According to the brand-new data, nearly $150 billion of section 199A deductions appeared on 18.7 million returns in 2018."

(Chart by Tax Analysts).

Biden-Harris Tax Proposals: Section 199A Disparities - Benjamin Willis and Jed Bodger, Tax Notes Opinions Blog. "Watch Benjamin M. Willis, contributing editor with Tax Notes Federal, and Jed Bodger, vice president of taxation at the Sierra Nevada Corp., discuss their recent article examining how the Biden-Harris proposed corporate tax and long-term capital gains rates increases logically lead to eliminating all or part of section 199A passthrough deduction to mitigate tax rate disparities and choice of entity gamesmanship."

Pros and Cons of a Do-It-Yourself Annuity in Retirement - Glenn Ruffenach, Wall Street Journal ($). "Retirement columnist Glenn Ruffenach also discusses the tax advantages of various options for charitable giving"

Taxpayer First Act Provision Only Applies to Tax Court Petitions Filed After July 1, 2019 - Ed Zollars, Current Federal Tax Developments. "While most readers are not going to be trying cases before the Tax Court that were filed before July 1, 2019, the case reminds those who represent taxpayers in innocent spouse cases in Appeals that Congress has attempted to incentivize taxpayers to cooperate in the Appeals process rather than decide to attempt to go straight to Tax Court in innocent spouse cases."

Tax Refunds and the Disposable Income Test - Marilyn Ames, Procedurally Taxing. "As illustrated by the Covid-19 payments recently dispersed by the Internal Revenue Service and the use of the IRS to carry out portions of Obamacare, Congress frequently uses the IRS and the Internal Revenue Code as a means of administering social programs that have little or nothing to do with taxes. One of the problems of using the IRS to execute these types of programs is that courts assume that all provisions in the Internal Revenue Code are tax-related, which can, at worst, result in decisions at odds with the purposes of these programs, and at best, create precedent that fails to acknowledge Congressional intent."

Former Ames Main Street business owner sentenced to 4 months in prison for failing to pay taxes - Danielle Gehr, Ames Tribune. "The former owner of Ames Main Street restaurants and bars was sentenced Tuesday in federal court for failing to pay employment taxes." Don't fail to do that.

Idaho grants tax relief to victims of recent disasters - Idaho State Tax Commission. "The Idaho State Tax Commission is extending deadlines to file and pay taxes for victims of Hurricane Laura, the California wildfires, and the Iowa derecho."

I'll just point out here that Iowa isn't giving filing deadline relief to victims of the Iowa derecho.

Mark Your Calendar: Affordable Care Act: 30 Minute Roundtable Friday, September 25, 2020. "Whether you’re dealing with confusion regarding filing obligations, new and changing regulations, or incorrect completion of forms, there are many ways companies can leave themselves at risk for large penalties."

Today in History: The first computer bug is identified in 1947. (The National Museum of American History). Technically, a moth.

We're Here to Help