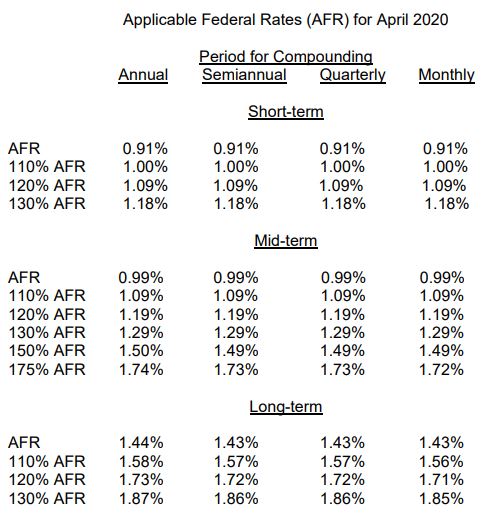

The IRS has released (Rev. Rul. 2020-09) the Applicable Federal Rates under Sec. 1274(d) of the Internal Revenue Code. These rates are used for various tax purposes, including minimum rates for loans.

There are rates for "short-term," "mid-term," and "long-term" instruments. Short-term covers demand loans and instruments extending up to three years. Mid-term covers loans cover instruments of over three years up to nine years. Long-term covers instruments with maturities longer than nine years.

Historical AFRs are available here.

We're Here to Help

From business growth to compliance and digital optimization, Eide Bailly is here to help you thrive and embrace opportunity.

Speak to our specialists