Even in the computer age, sometimes you just have to put pen to paper.

The IRS has come a long way in automation. About 90% of tax returns are filed electronically. Refunds get direct-deposited, and most business tax payments are paid electronically.

But the IRS still clings to paper for amended 1040s. If you are claiming a refund for an old tax year, that means dusting off the old ballpoint and signing the return. While that may not seem that big an obstacle, it was big enough to cost an Australian national a potential $1.7 million refund. Tax Notes Kristin Parillo reports on a case decided last week in the Court of Federal Claims ($):

Dixon didn’t sign the 2013 and 2014 amended returns. Instead, his return preparer signed them, but the preparer didn’t submit a signed power of attorney or other notice of his status as a fiduciary at the time he filed the amended returns.

Judge Hertling explains the rules (taxpayer and preparer name omitted):

The IRS argues that this Court lacks subject-matter jurisdiction over Taxpayer's suit because Taxpayer failed to satisfy the jurisdictional requirement of duly filing his amended returns for his refund claims for both 2013 and 2014. In support of its argument, the IRS notes that Taxpayer did not sign his amended returns under penalties of perjury, and Preparer, who did sign the forms, did not submit a signed power of attorney or other notice of his status as a fiduciary at the time he filed the amended returns. The relevant statutes and regulation require either the taxpayer's signature under penalties of perjury or an accompanying signed power of attorney if the taxpayer does not personally sign the form in order for a tax return to be “duly filed.” Thus, the IRS argues, Taxpayer's amended tax returns and the refund claims made in them were not “duly filed” and are invalid.

The Judge said there wasn't a properly executed power of attorney, so without the taxpayer's manual signature, the return wasn't properly filed.

Forbes Blogger Peter Reilly opines: "Reilly’s Fourth Law of Tax Planning - Execution isn’t everything, but it’s a lot- stands out as the lesson in a Court of Claims ruling in the case of Andrew C. Dixon."

The moral? Even in the digital age, sometimes only an analog signature will do.

Link to decision: Ct. Fed. Claims No. 1:19-cv-00270

IRS announces updated housing cost exclusion for Americans abroad. (Notice 2020-13)."Section 911(a) allows a qualified individual to elect to exclude from gross income the foreign earned income and housing cost amount of such individual." But only to a point. More information here.

Related: Eide Bailly Director of Mobility Services Jared Johnson will be giving a free webinar today (9:00 CST) on "Global Mobility: Tax Residency Planning and Compliance." Register here.

Don’t Overthink Crypto Checkbox, Rettig Says - Wesley Elmore, Tax Notes ($):

“If you have a virtual currency and you get a letter from us that says, ‘We have information that you might have participated in a virtual currency-type of transaction,’ I would suggest that you respond to it,” he said.

More on virtual currency issues here.

199A for Cooperative Patrons Generating Many Questions - Kristine Tidgren, The Ag Docket. "Must I reduce my QBI for purposes of the 199A(a) deduction by the section 199A(g) deduction since that deduction is attributable to my business? No. The statute prevents this result."

A very good summary of the rules for the "DPAD" reported by Ag co-ops.

Partnership Tax Ponderings – Flow-Through and Basis - Roger McEowen, Agricultural Law and Taxation Blog. "Liability protection can be achieved by holding the partnership interests in some form of entity that limits liability – such as a limited liability company. But, with partnerships comes tax complexity. When a partnership interest is transferred (by sale, gift or upon death) the tax consequences can become complicated quickly."

Related: Adam Sweet, Choice-of-Entity Under the New Tax Law.

Lesson From The Tax Court: What Is 'New Matter' That Shifts Burden Of Proof To IRS? - Bryan Camp, TaxProf Blog. "Because the IRS had not introduced any evidence to show how the taxpayer had misapplied §409A, the Court handed the taxpayer a sweet, sweet victory."

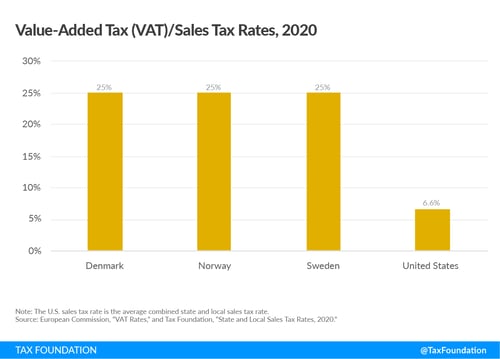

Insights into the Tax Systems of Scandinavian Countries - Elke Asen, Tax Policy Blog. There is much talk about the Scandinavian model of taxes. Ms. Asen explains:

Scandinavian countries tend to levy top personal income tax rates on (upper) middle-class earners, not just high-income taxpayers. For example, in Denmark the top statutory personal income tax rate of 55.9 percent applies to all income over 1.3 times the average income. From the American perspective, this means that all income over $65,000 (1.3 times the average U.S. income of about $50,000) would be taxed at 55.9 percent.

The Top US rate kicks in for unmarried individuals at $510,300. Also:

Much more at the link.

Let The Dust Settle On The TCJA Before Judging Its Effectiveness - Aparna Mathur, TaxVox. "The fact that the TCJA passed without any Democratic support is itself a source of uncertainty about the future of American tax law. What happens if a Democrat wins the White House? There is a high probability that rates would go back up, possibly to 25 or 28 percent."

Did you know? The IRS has a web page where you can check on the status of your refund.

We're Here to Help