Iowa Governor Drops a New Tax Bill

Governor Reynolds introduced a proposal for individual income tax cuts paired with an increase in the state sales tax rate. The proposal, SSB3116, includes revisions to the major overhaul of the Iowa tax code that passed in 2018. A few highlights below:

Income Tax Reform

Effective for 2021, Iowa Individual tax rates would drop from a top rate of 8.53% to 7.48%. The number of tax brackets would be reduced from nine to eight.

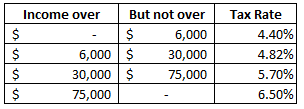

While tax rates were lowered in the first round of tax reform in 2018, they were set to be further reduced in 2023 (or later – referred to as the “trigger year”) if the State hit two revenue targets in the previous fiscal year: 2022 (or later) general fund revenue of at least $8.3146 billion, and 4% growth net general fund revenue growth. The proposal removes the second requirement of 4% growth from the trigger. When that happens, current law replaces Iowa’s eight-bracket individual income tax rate schedule with a four bracket schedule featuring lower rates – but no deduction for federal taxes paid. Here is the contingent 2023 schedule for single filers (double all income numbers for joint filers):

The existing four-bracket schedule actually would result in a substantial effective marginal rate increase for top-bracket taxpayers. When taking federal tax deductibility into account, Iowa’s top marginal tax rate is about 5.2%; 6.5% represents a 25% increase.

Governor Reynolds would bring the 2023 rates down further, proposing this single-filer table:

Sales Tax

Beginning January 1, 2021 Iowa’s sales tax rate would increase from 6% to 7%. The proposal would exempt feminine hygiene products and diapers for children and adults from sales and use tax.

The increase to Iowa’s sales tax would now help fund a newly created Natural Resources and Outdoor Recreation Trust Fund to support the protection and enhancement of Iowa’s water quality and natural areas. Related administrative changes will require the appointment of a committee to review the trust fund and its allocations.

Credits

Iowa allows qualifying taxpayers to take one of two credits related to childcare: The Child and Dependent Care Credit or the Early Childhood Development Credit. The bill doubles the Iowa net income eligibility threshold for both credits from $45,000 to $90,000 beginning in 2021.

The bill would create a new credit: the “Preceptor Tax Credit.” A “preceptor” is a licensed practicing physician providing on-site education to a medical student or resident at a hospital or medical clinic in a rural area. A nonrefundable tax credit to the preceptor of $1,000 per student or resident supervised could be available after 2021, with a maximum credit of $10,000 per year. But they must act quickly, as credits will be issued on a first-come-first-serve basis from a pot of $100,000. More guidelines will be developed if the bill passes.

What’s Missing

Several items talked about for this General Assembly Session are missing from the Governor’s proposal. These include reductions in Iowa’s corporation tax rate, fixing flaws in Iowa’s taxation of foreign corporations, and issues in Iowa’s capital gain exclusions on business sales.

It’s early in the session; we will follow developments closely.We're Here to Help