Key Takeaways

- Given its critical role in daily operations and long-term success, strategic accounting is a must in today’s dynamic business landscape.

- Tracking the right information is crucial for driving informed decisions that lead to improved operations.

- When it comes to streamlining processes and implementing or optimizing technology, proper change management is vital for a successful transition.

Accounting serves as the language of business, narrating your organization's journey from its past to the present and guiding its future. Given its critical role in daily operations and long-term success, strategic accounting is a must. It's not just about doing things right; it's about doing them strategically to make informed decisions.

Your organization is like a living entity, constantly evolving, and to keep pace with this evolution, your accounting practices must adapt. Static accounting processes can lead to stagnation across your organization. Whether you need minor adjustments or a complete overhaul, it all begins with a fundamental evaluation, starting at the beginning.

1. Understand Your Key Metrics

Effective accounting begins with a deep understanding of your business and industry. This involves grasping essential accounting metrics that provide insights into your financial health:

- Profit and Profit Margin

- Payroll

- Accounts Payable and Accounts Receivable

- Inventory

- Cash flow

2. Determine What Information to Track

Tracking the right information is crucial for building accounting records that drive informed decisions. Ensure you capture all transactions efficiently, cash and noncash, tailored to your business or industry's needs.

Ask yourself questions like:

- Should I track direct and indirect costs for a comprehensive view of profitability?

- Do I have multiple departments or product lines that require individual tracking?

- Are commission transactions linked to sales representatives, necessitating detailed tracking?

- Do I operate in multiple states, requiring state-specific tracking for tax purposes?

- What sales tax jurisdictions should I monitor for tax reporting?

- Are there specific items like meals or donations that need tracking for tax purposes?

Effective tracking goes beyond easy-to-access data, focusing on meaningful information. For instance, relying solely on sales figures might overlook critical details, such as profit margins.

There is a key difference between the numbers that are easy to track and those that are meaningful. Be intentional about what you monitor and measure to anticipate future success.

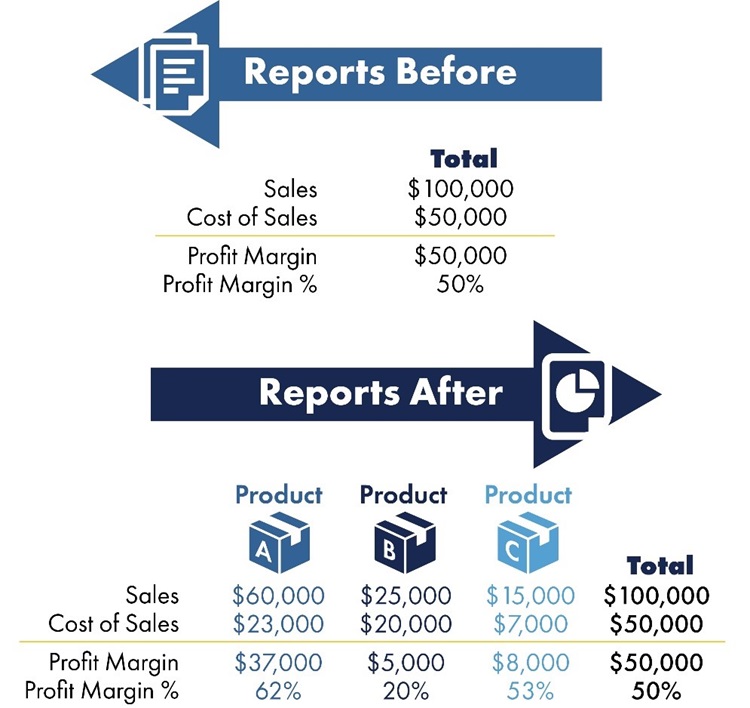

In this example, you can see that displaying your data by product type rather than by total makes it easy to evaluate where to invest more resources.

If you focus on Product B, you’ll keep only $0.20 of every dollar in sales (and that's before any overhead costs). An increase in sales volume in this category would not equate to the largest increase in net income or cash flow. Focusing sales efforts on Product A or C makes more sense, where the profit margins are higher.

By aligning the details of your data input around your desired reporting output, you can see actionable information to help drive your decision-making.

3. Track Metrics with Financial Statements

Accurate financial statements are vital for running your organization effectively and making informed decisions.

Your financial statements illuminate various aspects of your business, including:

- The Balance Sheet: reflecting your organization's resources, liquidity, and equity

- The Income Statement: providing insights into profitability over a specific period

- The Statement of Cash Flows: tracing the sources and uses of your cash

You can take your financial statements to the next level by comparing your current performance against historical performance, benchmarking yourself against your industry and peers, and projecting your future performance.

4. Implement Digital Solutions

Remaining complacent with old practices can hinder your organization's growth. Evaluating processes early enables proactive improvements, preventing crises arising from outdated systems. Embracing change is a critical first step to optimize operations across your organization.

Optimizing accounting processes requires embracing technology and automation.

Access to real-time data through technology streamlines operations and allows your team to focus on high-value tasks. Automation eliminates manual data entry, freeing up resources for more impactful work.

While change can be challenging, digital solutions should not be seen as threats to job security. Instead, they empower your employees to concentrate on value-added activities.

5. Prepare Your Team for Change

When streamlining processes and implementing or optimizing technology, proper change management is vital for a successful transition and requires leadership alignment, open communication, skill repurposing, patience, and consistency.

Here are some tips to help your team during the transition:

- Lead with enthusiasm: To inspire enthusiasm for change, leaders must set an example by being enthusiastic themselves. Start by setting realistic goals, sharing your expectations, and explaining the desired outcomes.

- Encourage open communication: Create an environment of communication and transparency by clearly stating the objectives of implementing new processes, technology, automation, or changes in roles and responsibilities. Allow employees to provide feedback, ask questions, and be open about your plan.

- Leverage employee skills: Make the most of your employees' skills and talents. If a task that used to require two people can now be done by one due to automation, consider repurposing the second person to a different role that aligns with their abilities and interests.

- Exercise patience and consistency: Change takes time and doesn't happen overnight. Stay patient throughout the process and consistently follow your plan to make progress.

- Seek external assistance: A team of experienced advisors can assist with evaluating your processes, devising a change plan, and managing the transition within your organization.

Having stagnant accounting processes is a surefire way to stagnate your entire organization. Whether your accounting processes need a few minor tweaks or a giant overhaul, the starting point for your journey is the same – the beginning.

An experienced advisor with specialized expertise can be invaluable in guiding your organization toward significantly improved operations.

Eide Bailly’s outsourced and managed services team can help you take a strategic approach to your accounting functions, eliminating inefficiencies and using digital solutions to improve operations within your finance team and across the organization.

Elevate Your Organization to New Heights

Outsourced & Managed Services

Outsourcing core business functions can help streamline processes, eliminate inefficiencies, and improve business operations.

Who We Are

Eide Bailly is a CPA and business advisory firm helping our clients grow, thrive, and embrace opportunities and innovation.