Key Takeaways

- The California Competes Tax Credit is a nonrefundable income tax credit available until 2028. It is designed to alleviate the impact of rising operational costs in the state.

- The California Competes Tax Credit application process involves two phases: a cost-benefit ratio and demonstrating the ability to generate potential new high-quality jobs in California.

- Once a business qualifies, it must pledge to meet yearly milestones and provide documentation demonstrating eligibility.

California created the California Competes Tax Credit (CCTC) encouraging companies to remain in the state. This credit, distributed under a five-year agreement, is a nonrefundable income tax credit primarily intended for businesses aiming to sustain or grow operations within the state.

Who is eligible for the California Competes Tax Credit?

Applications are open to any taxpayer, regardless of industry or size, including individuals, corporations, or partnerships. Applicants must apply during the designated periods and receive approval to obtain the credit.

The CCTC application is available online at www.calcompetes.ca.gov for no fee during the following upcoming application windows:

- July 22, 2024 – August 12, 2024

- January 6, 2025 – January 27, 2025

- February 24, 2025 – March 10, 2025

What is the application process for the California Competes Tax Credit?

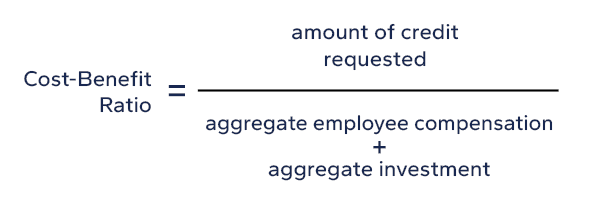

The application process occurs in two phases. The first phase is based on a quantitative analysis and cost-benefit ratio.

Phase I

Applications with the most advantageous cost-benefit ratio move to the second phase, provided applicants request a minimum total credit amount of $20,000. California prefers a low percentage cost-benefit ratio, as it aims to provide an incentive to conduct business within California rather than directly finance projects.

Each application period has a maximum ratio based on data from applicants applying during the applicable period. For example, during the third application round of 2022, the maximum ratio allowed to move an application into Phase II (excluding exemptions described below) was .0779.

There is an alternative method to move directly to Phase II regardless of the ratio. An applicant who certifies either of the following will be moved forward to Phase II:

- At least 75% of the applicant’s net increase of full-time employees work at least 75% of the time in an area of high unemployment or high poverty; or

- Absent the award, the applicant’s project will occur in another state, or the applicant will terminate or relocate employees to another state.

Phase II

During the second phase, the state considers a range of quantitative and qualitative factors, including:

- Local rates of unemployment and poverty

- Competing incentives available to the business

- Economic impact

- Strategic significance

- Industry projections

- The extent to which the applicant demonstrates the credit’s substantial influence on its capacity to generate new, high-quality full-time jobs in California.

Beginning in the 2023-24 application periods, California will also consider an applicant’s willingness to relocate to California from a state enacting laws that California determines are unfavorably affecting discrimination protections based on sexual orientation, gender identity, or expression or interfering with female reproductive rights.

Additionally, California might consider the applicant’s dedication to equitable treatment of their workforce, including a limited history of safety concerns or ongoing legal matters and implementation of training or career advancement initiatives.

What are the next steps once an applicant qualifies and accepts the credit?

Upon acceptance of the CCTC, applicants negotiate with the California Governor’s Office of Business and Economic Development (“GO-Biz”) to formalize the five-year agreement.

The applicant pledges to meet yearly milestones and furnish appropriate evidence of qualification for each of the five years. Failure to reach these milestones can result in a recapture of the credit. If the applicant is unsuccessful in obtaining the credit, the applicant may revise and resubmit the application in a subsequent application period.

Next steps in the California Competes Tax Credit

The CCTC is intended to promote business growth and stability within California amidst rising costs. This credit presents significant tax savings for businesses established in California or out-of-state businesses interested in relocating to California.

Once an applicant is accepted into the program and has satisfied the qualifications, it may carry forward any unused credit for six years. Further, GO-Biz has allocated $164 million in credits for each upcoming application period, emphasizing the magnitude of tax savings available for California businesses and those looking to relocate to California.

Stay Up to Date on the Latest Tax News

State and Local Tax

A trusted team can take the headache out of your sales and income tax compliance needs.

Who We Are

Eide Bailly is a CPA and business advisory firm helping our clients grow, thrive, and embrace opportunities and innovation.