Key Takeaways

- IRS loudly announces effort to stem abuses of business jets.

- Effort will target private use of corporate jets.

- Executives must pay tax on personal use of business aircraft.

- Senate Finance report condemns private placement life insurance.

- IRS Direct File expands - if you log in during "limited and unannounced windows."

- Europe Tax Rates

- How not to get a donation appraisal.

- Cook a Sweet Potato Day, Chili Day.

Using Inflation Reduction Act funding and as part of ongoing efforts to improve tax compliance in high-income categories, the Internal Revenue Service announced today plans to begin dozens of audits on business aircraft involving personal use.

The audits will be focused on aircraft usage by large corporations, large partnerships and high-income taxpayers and whether for tax purposes the use of jets is being properly allocated between business and personal reasons.

The IRS will be using advanced analytics and resources from the Inflation Reduction Act to more closely examine this area, which has not been closely scrutinized during the past decade as agency resources fell sharply. The number of audits related to aircraft usage could increase in the future following initial results and as the IRS continues hiring additional examiners.

While this likely is justifiable strictly from a revenue standpoint, I think the IRS is betting that is a good move for them politically - which is why they are advertising it. Going after jet owners may be good PR, as few "middle class" taxpayers have this issue.

I.R.S. to Crack Down on Corporate Jet Users Who Abuse Tax Code - Alan Rappeport, New York Times. "The I.R.S. audits will go beyond the companies that own the jets to include the wealthy passengers, who the tax agency says should be reporting those trips as income."

Are Executives Abusing Corporate Jets? The IRS Wants to Know. Ashlea Ebeling and Theo Francis, Wall Street Journal. "For tax purposes, businesses need to track how much the jets are flown for business and personal use. That can mean recording everyone who was on a flight and for what purpose. The records should be contemporaneous, not created once the IRS comes calling."

IRS Gears Up for Corporate Jet Dogfight - Jonathan Curry, Tax Notes ($). "Michael Kaercher of the Tax Law Center at New York University School of Law said that in scrutinizing corporate jet use, the IRS may find some low-hanging fruit. Recurring flights between an executive’s workplace and a known vacation destination 'may be a good flag,' he suggested, and where there’s a pattern of noncompliance, 'the adjustments could be substantial.'"

Meanwhile on the Ground

Senate report blasts high-end life insurance plans as $40B ‘tax dodge’ - Julie Zauzmer Weill, Washington Post

Specialized life insurance plans offered only to the wealthiest Americans are a vehicle for dodging billions in taxes, a Senate report released Wednesday charged.

...

The plans, called Private Placement Life Insurance (PPLI), stand apart from the life insurance policies that millions of Americans purchase to hedge against a family breadwinner’s untimely death, in which buyers pay set premiums and expect a certain benefit for their heirs after they die, or make limited publicly traded investments within their life insurance policies.

Wyden Plans Crackdown on Custom Life Insurance ‘Tax Shelter’ - Chandra Wallace and Lauren Loricchio, Tax Notes ($):

PPLI, also called an “insurance wrapper,” is a type of customized life insurance marketed to wealthy investors. A PPLI policy is structured as a private contract between the insurer and the investor and lets the investor “wrap” an investment portfolio within the life insurance. Under the rules applicable to life insurance, the investment portfolio then accumulates value and is transferred to insurance beneficiaries tax free. PPLI portfolio assets can include hedge funds, private equity funds, real estate, or even entire businesses, the report notes.

...

According to one PPLI professional, the $40 billion top-line number in the report doesn’t accurately represent the amount of wealth being passed on through PPLI policies.

“It’s a misnomer that the current face value of a policy means that that’s what’s going to be paid,” Sam Jensen of 3cStructures told Tax Notes. “It’s an overstatement completely.”

Link: Senate Finance report.

Related: Eide Bailly Wealth Transition Services.

FinCEN Issues Guide for Small Banks on Access to Ownership Info - Michael Rapoport, Bloomberg ($):

Small financial institutions have a new compliance guide on accessing company ownership information being collected by a Treasury Department unit under a new law that became effective Jan. 1.

The guide issued Tuesday by Treasury’s Financial Crimes Enforcement Network, or FinCEN, is aimed at small financial institutions that might have reason to access the “beneficial ownership” information.

The IRS’s new free tax filing website is ready to use - Julie Zauzmer Weil, Washington Post. "The IRS’s new Direct File website, a free site for filing a tax return, will open to the public in the coming days, the IRS announced Wednesday. But anyone who hopes to be among the first to use it will have to get lucky and check the website during limited and unannounced windows at the outset."

Interesting that IRS is using Zulily's model in rolling out its new service, considering how it worked out for them.

Tax Time Guide 2024: What to know before completing a tax return - IRS:

Taxpayers are advised to wait until they receive all their proper tax documents before filing their tax returns. Filing without all the necessary documents could lead to mistakes and potential delays.

It’s important for taxpayers to carefully review their documents for any inaccuracies or missing information. If any issues are found, taxpayers should contact the payer immediately to request a correction or confirm that the payer has their current mailing or email address on file.

Creating an IRS Online Account can provide taxpayers with secure access to information about their federal tax account, including payment history, tax records and other important information.

Having organized tax records can make the process of preparing a complete and accurate tax return easier and may also help taxpayers identify any overlooked deductions or credits.

Kansas Lawmakers Fail to Override Veto of Flat Tax Bill - Emily Hollingsworth, Tax Notes ($). "Although lawmakers approved a February 20 motion to override Kelly’s veto of H.B. 2284 on a vote of 81 to 42, the vote fell short of the two-thirds majority required under the state constitution."

Blogs and Bits

COVID task force PPP investigation results in 2 more convictions - Kay Bell, Don't mess With Taxes. "Prosecutors showed that the co-conspirators falsely reported that each business had approximately 60 employees and approximately $300,000 in average monthly payroll expenses. To support these payroll figures, each business' loan application was accompanied by an Internal Revenue Service Form 941, which employers use to report payroll taxes. In reality, said federal officials, each Form 941 was fraudulent."

Tips for Avoiding Incorrect Forms 1099-K - Erin Collins, NTA Blog. "Another important point is that if you operate a business and accept payment through one of these apps, the IRS has recommended that you create a separate personal account for personal use. Use your business account for business purposes and your personal account to receive payments for personal transactions. Otherwise, personal payments will end up on your business’s Form 1099-K, and you or your tax professional will then have to sort out personal and business payments when preparing your tax return."

IRS announces underpayment, overpayment rates for 2024 Second Quarter - Bailey Finney, Eide Bailly. "8% for underpayments"

International Tax Corner

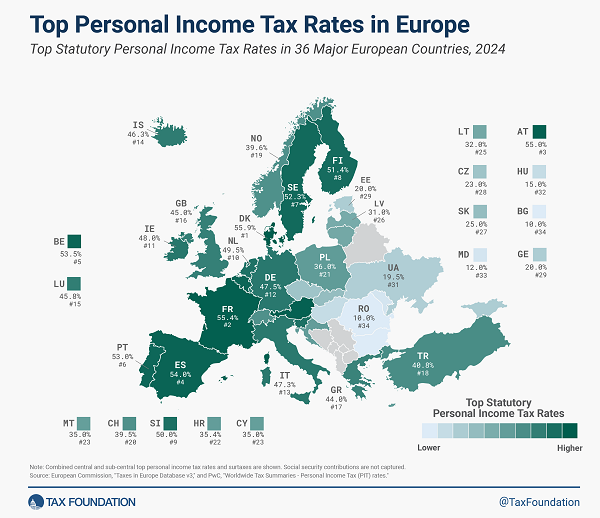

Top Personal Income Tax Rates in Europe, 2024 - Alex Mengden, Tax Foundation.

Among European OECD countries, the average statutory top personal income tax rate lies at 42.8 percent in 2024. Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top rates. Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) have the lowest top rates.

...

For comparison, the average combined state and federal top income tax rate for the 50 U.S. states and the District of Columbia is 42.32 percent as of January 2024, with rates ranging from 37 percent in states without a state income tax to 50.3 percent in California.

The top rates in Europe tend to take effect at much lower income levels than the top U.S. brackets. For example, the top 44% bracket for federal taxes in Finland starts at about $US 162,143, while the top 37% rate in the U.S. starts at $578,126.

The Pillar Two/Foreign Tax Credit Continuous Feedback Loop - Alex Parker, Things of Caesar:

In the U.S., there’s already an early example of this in recent regulatory guidance from the Department of the Treasury. Notice 2023-80, released in December, outlines some preliminary indications for how it plans to treat Pillar Two taxes imposed foreign countries, for application of the foreign tax credit. Tax practitioners are already raising concerns that it goes beyond statutory authority and could lead to double taxation in some instances.

Meshing the often byzantine and arcane U.S. tax code with this expansive, brand-new global tax regime is going to be a bumpy ride–especially as Congress is unlikely to provide any help.

Bold International Tax Reforms to Counteract the OECD Global Tax - Leonard Wagenaar, Leonards Tax Posts. "If Congress rejects the OECD, it is not clear why the OECD countries wouldn’t be able to go ahead."

How do Estate Tax Treaties Work? They Don’t if the Decedent is a US Citizen or Domiciliary - Virginia La Torre Jeker, U.S. Tax Talk. "It is very important to note that using an estate tax treaty generally means that the worldwide value of assets must be revealed to the Internal Revenue Service on the US estate tax return. Additionally, when an estate claims treaty benefits, a special notice claiming those treaty rights must be filed with the estate tax return using Form 8833, Treaty-Based Return Position Disclosure."

Related: Eide Bailly Foreign Trust & Estate Tax Compliance & Planning.

Tales from the Tax Court, Bad Appraisal Division

IRS’s Denial of $20.67 Million Land Donation Deduction Gets Nod - John Woolley, Bloomberg ($). "The IRS properly disallowed a $20.67 million conservation easement charitable contribution deduction claimed by a partnership in Georgia because the partnership failed to attach a qualified appraisal of the property to its tax return, the US Tax Court said Wednesday."

The Tax Court ruled against the deduction on two grounds: that the appraisal used to support to the deduction was not "qualified" as required by the tax law, and that the property was ordinary income property, rather than capital gain property, so that a fair market value contribution was unavailable.

A conservation easement is "a permanent agreement between a landowner and a qualified conservation group" that limits development of a property. The value of the deduction is difference between the appraised value of the land with and without the development restriction.

The opinion discusses unsuccessful attempts to sell property, including that subject to the claimed easement, for prices up to $7.7 million. The court found that the taxpayer and the appraisers "had reached a meeting of the minds" to come in with a much higher value. The total appraised values of the easements came in at $52.8 million, including the $20.67 million attached to the easement in the case. That prevented the appraisal from being "qualified." From the Tax Court opinion (taxpayer names omitted):

In sum, the Partners at year-end 2015 knew the Parent Tract was worth less than $10 million, having recently offered it for sale (unsuccessfully) at prices between $6.7 million and $7.9 million. Yet through their intermediaries they reached a meeting of the minds with Messrs. Wingard and Van Sant that the Parent Tract would be appraised (before carve-outs) in the neighborhood of $60 million. The facts here fit squarely within the example set forth in the regulation, where “the donor and the appraiser make an agreement concerning the amount at which the property will be valued and the donor knows that such amount exceeds the fair market value of the property.” Treas. Reg. § 1.170A-13(c)(5)(ii). Because the Partners “had knowledge of facts that would cause a reasonable person to expect the appraiser falsely to overstate the value of the donated property,” ibid., Messrs. Wingard and Van Sant were not “qualified appraisers” with respect to this particular donation.

When a donation of property requiring a appraisal is made without a "qualified" appraisal properly reported with the return, the allowable deduction becomes zero. All charitable donations from $5,000 up, except publicly-traded securities, require a qualified appraisal.

The Moral? Conservation easements are a legitimate deduction when the property qualifies, when a proper appraisal is obtained, and when IRS reporting requirements are met. Rigged appraisals don't do the trick.

Related: Eide Bailly Business Valuation Services.

What Day is It?

Try them together. It's National Chili Day and National Cook a Sweet Potato Day!

Make a habit of sustained success.