IRS Audit Rates Cratered Over Last Decade, GAO Says - Asha Glover, Law360 Tax Authority ($):

The Internal Revenue Service's individual income tax return audit rate has declined sharply over the last decade, with the audit rate decreasing most for high-income earners, according to a U.S. Government Accountability Office report released Tuesday.

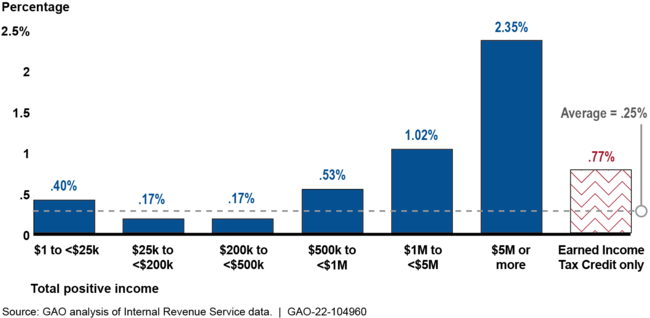

The IRS' audit rate for individual income tax returns for all income levels fell from 0.9% to 0.25% from 2010 to 2019 due to reductions in funding and staffing, according to the GAO's report.

From the GAO report:

From tax years 2010 to 2019, audit rates of individual income tax returns decreased for all income levels. On average, the audit rate for these returns decreased from 0.9 percent to 0.25 percent. Internal Revenue Service (IRS) officials attributed this trend primarily to reduced staffing as a result of decreased funding. Audit rates decreased the most for taxpayers with incomes of $200,000 and above. According to IRS officials, these audits are generally more complex and require staff's review. Lower-income audits are generally more automated, allowing IRS to continue these audits even with fewer staff.

Although audit rates decreased more for higher-income taxpayers, IRS generally audited them at higher rates compared to lower-income taxpayers, as shown in the figure. However, the audit rate for lower-income taxpayers claiming the Earned Income Tax Credit (EITC) was higher than average. IRS officials explained that EITC audits require relatively few resources and prevent ineligible taxpayers from receiving the EITC.

The report includes this chart of examination rates by income levels:

The report also had some counter-intuitive and politically-fraught information on low-income taxpayer examinations:

Audits of the lowest-income taxpayers, particularly those claiming the EITC, resulted in higher amounts of recommended additional tax per audit hour compared to all income groups except for the highest-income taxpayers. IRS officials explained that EITC audits are primarily pre-refund audits and are conducted through correspondence, requiring less time. Also, lower-income audits tend to have a higher rate of change to taxes owed.

Attrition and COVID Took Toll on IRS’s Audit Capacity - Jonathan Curry and Doug Sword, Tax Notes ($):

The average number of hours spent on audits over the last decade jumped 30 percent, from five hours in fiscal 2010 to 6.5 in fiscal 2021, the GAO said in a report (GAO-22-104960) released May 17.

That increase is due in part to rapid turnover, according to the IRS. The agency told the GAO that incomplete audits are increasingly being transferred between staff, who then need more time to get caught up on the audit.

IRS audit rates plummet, especially for wealthy - Michael Cohn, Accounting Today:

House Ways and Means Oversight Subcommittee chair Bill Pascrell, D-New Jersey, had requested the GAO report and he blasted the findings.

“The findings by the GAO on IRS auditing rates are another five-alarm fire bell for our national tax system,” Pascrell said in a statement Tuesday. “Over the last decade, accountability for the wealthiest tax cheats has plummeted so far it almost hits the floor. Looking at the numbers, a tax filer making less than $25,000 a year is more than twice as likely to be audited as someone with between $200,000 and $500,000 in income. I worry well-off taxpayers are not going to be pursued at the rate things are going.”

‘An insult to working people’: Democrats struggle with next tax move - Brian Faler, Politico:

Illustrating the political challenges to restoring full expensing of research costs.Democrats’ failure to extend their monthly child payment program — not to mention raise taxes on big companies — has left some wary of helping businesses, including on relatively uncontroversial issues.

Democrats actually supported the proposal in question — easing new restrictions that make it harder for tech companies to deduct their research expenses — as part of their reconciliation plan last year, although it attracted little notice.

IRS, Reversing Course, Tees Up Potential Tax Fight With Multinational Companies - Richard Rubin, Wall Street Journal ($). It involves the deduction for "Foreign Derived Intangible Income," or FDII. From the article:

In a memo to agency lawyers, Peter Blessing, the top international tax attorney at the IRS, outlined how the government intends to calculate the deduction for companies that fit two criteria: They have U.S. profit they earned from foreign sales and deductions for payments under deferred share-based compensation plans, such as restricted stock units granted in earlier years that vested after 2017.

In the memo, Mr. Blessing said the IRS was reversing a position it had taken on an analogous issue in 2009. That shift means companies that had calculated the deduction based on past IRS practice may find themselves facing unexpected tax bills.

Related: Tax Reform: What Does It Mean for My International Business.

US Is World's Best Location For Hiding Income, Index Says - Dylan Moroses, Law360 Tax Authority ($). "The U.S. is considered the best country in the world in which to hide income from tax and government authorities, according to this year's index unveiled Tuesday listing the most financially secretive jurisdictions as determined by the Tax Justice Network."

Lawmakers seek mileage deduction increase to counter gas price hikes - Jay Heflin, Eide Bailly. "The letter suggests that Rettig can unilaterally increase the mileage deduction. At this point, it is not clear how the Commissioner will respond to the lawmakers’ request."

Tax Lawyers Find New Obstacles Defending Client Crypto Positions - Nathan Richman, Tax Notes ($). "The IRS’s position is that taxpayers moving their cryptocurrencies between their own wallets haven’t engaged in taxable transactions, but while some taxpayers may try to hide behind the perceived anonymity, others are finding that it makes it hard to prove to revenue agents that they hold all those wallets."

Man Loses FBAR Case, But $276K Penalty Could Be Lowered - Daveid Hansen, Law360 Tax Authority ($). "A New Jersey man accused of concealing his foreign bank accounts from the Internal Revenue Service lost his case but will get a chance to lower the $276,000 in damages sought by the U.S. government, a federal court ruled."

Related: International Penalty Abatement (video).

NM wildfire victims get Tax Day, other filing/payment deadlines, pushed to Aug. 31 - Kay Bell, Don't Mess With Taxes. "The IRS announcement says individuals and businesses in the disaster designated counties now have more time to deal with tax deadlines that fall between the fires' start on April 5 and Aug. 31. The new due day for these tax responsibilities now is Wednesday, Aug. 31."

Payments Made by Physician Ruled Not to Be Deductible Alimony - Ed Zollars, Current Federal Tax Developments. "While the Tax Cuts and Jobs Act ended the deduction for alimony payments for divorces finalized after 2018, we still have to deal with the status of payments for divorces prior to that date."

Court Rules IRS Is Too Late To Audit, Win For Taxpayers - Robert Wood, Forbes. "If you somehow end up filing with the IRS late—days, or even years late—you want to measure that IRS three years from your actual filing."

Advising Gig Workers: Form 1099-K and How to Minimize Tax Liability - Thomson Reuters Tax & Accounting. "For example, freelancers who make money from Etsy businesses or driving for Uber should have been paying taxes on net business income all along. But Congress and the IRS know that self-employed gig workers are falling short of their responsibility to report income."

Lesson From The Tax Court: Only One Exclusion For Military Retiree Disability Payments - Bryan Camp, TaxProf Blog. "But her 90% disability rating did not prevent her from working."

U.S. Official Can't Deduct Losses from Sales of Properties Purchased Using Ill-Gotten Funds - Parker Tax Publishing. "The Tax Court held that a taxpayer who, using his position as a U.S. consular official, took bribes in exchange for facilitating approvals of nonimmigrant visas and used the bribery proceeds to purchase real estate in Thailand which he later sold pursuant to a forfeiture agreement with the government, could not deduct his losses from the sales because that would undermine the public policy against bribery."

A Very Bad Reason That Taxes Had to Be Increased - Jim Maule, Mauled Again. ...the small town of Corsica, in Jefferson County, Pennsylvania, was compelled to double its property tax rate. According to this story, the town did so because the town secretary embezzled so much money over a eight-year period that the town was unable to maintain a children’s playground or fix its deteriorating roads."

Related: Why You Need to Understand the Importance of Forensic Accounting.

TCJA Led Foreign-Owned Corporations to Retain More Earnings in the US - Thornton Matheson and Thomas Brosy, TaxVox. "Corporate tax reforms introduced by the 2017 Tax Cuts and Jobs Act (TCJA) encouraged foreign-owned US companies to reinvest more of their earnings here, according to a new TPC study. The study also finds a positive relationship between the TCJA tax cuts and foreign-owned companies’ investment in US tangible assets."

U.S.-China Trade War Hurt American Industries and Workers - Alex Durante, Tax Policy Blog. "The trade war has not yielded any tangible benefits for U.S. firms and workers. While the U.S. tariffs were intended to protect American industries, they have largely hurt the U.S. economy. And they incentivized foreign countries to retaliate with their owns tariffs, which have damaged the economy even more."

15th Anniversary of the 21st Century Taxation Blog - Annette Nellen, 21st Century Taxation. Congratulations to Annette. It's not easy to post regularly, let alone for 15 years.

Wash 'em if you got 'em. Today is National No Dirty Dishes Day.

We're Here to Help